British Columbians’ debt concerns grow

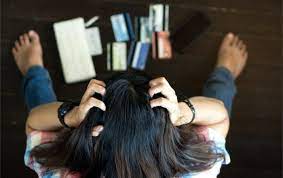

British Columbians’ anxiety about their debt situation is building amid rising interest rates, persistent inflation, and heightened affordability concerns.

The latest MNP Consumer Debt Index finds significantly fewer British Columbians are confident in their ability to cover all of their living/family expenses in the next year without going further into debt (52 per cent) — plunging a record seven points from the previous quarter. Nearly half of British Columbians say they regret the amount of debt they’ve taken on in life (46 per cent), increasing by five points. Additionally, more British Columbians say they’re concerned about their current level of debt (43 per cent, +3 pts).

The MNP Consumer Debt Index is conducted quarterly by Ipsos to track Canadians’ attitudes about their debt situation and their ability to meet their monthly payment obligations. It has taken a drastic plunge to 77 points, down a record 15 points and marking an all-time low since the Index was created more than five years ago.

“The shift we are seeing in British Columbians’ attitudes towards their personal debt mirrors the successive interest rates hikes and persistent inflation we saw in 2022,” says Linda Paul, a Licensed Insolvency Trustee with MNP LTD in the Lower Mainland. “Many are being hit with a double whammy. While everyone is seeing inflation eat away at their household budgets, those who are overleveraged are also facing the pinch of rapidly rising borrowing costs.”

Not surprisingly, British Columbians are feeling significantly worse about their ability to absorb interest rate increases. Two in three British Columbians (65 per cent) say they are already feeling the effects of last year’s seven interest rate increases, jumping five points since last quarter. Spiking 11 points, significantly more now say their ability to absorb an interest rate increase of one percentage point has worsened (24 per cent). About three in five say they’re more concerned about their ability to pay their debts as interest rates rise (62 per cent, +11pts), and that they’ll be in financial trouble if interest rates go up much more (55 per cent, +7 pts).

Rising costs are being felt by a growing proportion of British Columbians. More than half say feeding themselves and their family (58 per cent, +7 pts), putting money aside for savings (57 per cent, +4 pts) and transportation (54 per cent, +8 pts) are less affordable. About half also say clothing or other household necessities (51 per cent, +8 pts) and housing (48 per cent, +8 pts) are becoming less affordable.

“Many individuals are already spending nearly all their monthly income and have very little wiggle room to accommodate any kind of increase to their expenses or debt-carrying costs. British Columbians who are in this position often resort to taking on more debt to preserve their standard of living,” explains Paul.

More British Columbians are already resorting to reducing their monthly debt repayments or taking on more debt to make ends meet. Compared to December 2021, significantly more say they’ll use their credit card to pay their bills (15 per cent). Jumping six points, that’s the largest increase amongst all provinces. More British Columbians also say they have paid only the minimum balance on their credit card (24 per cent, +2 pts), borrowed money they can’t afford to pay back quickly (16 per cent, +4 pts), or paid the minimum balance on their line of credit (14 per cent, +2 pts). One in five say they will use their savings to pay their bills (20 per cent, -1 point), while one in 10 say they’ll borrow from friends or family (14 per cent, +7 pts). A third plan on reducing their discretionary expenses to make ends meet (36 per cent), increasing four points since last quarter.

“Taking on more debt can have lasting financial impacts and push some into a debt spiral that is difficult to break free from. Unfortunately, more individuals are being forced to make tough financial decisions to get by. Financial struggles can also have a significant impact on mental health, as the burden of debt can often trigger stress and anxiety,” says Paul.

Increasing two points since last quarter, two in five (44 per cent) British Columbians report they are $200 away or less from not being able to meet all of their financial obligations at month end. This includes three in 10 (31 per cent) who already don’t earn enough to cover their bills and debt obligations, jumping eight points, the largest increase amongst the provinces.

“British Columbians should be on the lookout for any financial red flags as the holiday bills arrive this month. These may point to the need for professional debt advice,” says Paul. “If consumers find they’re using other forms of credit to pay bills or are unable to cover bills or anticipate missed payments, the best course of action is to seek the guidance of a debt professional like a Licensed Insolvency Trustee before those financial problems escalate.”

Debt-relief options can include striking a deal with creditors through an informal debt settlement, consolidating all debts into one monthly payment, making a debt repayment plan through a Consumer Proposal, or declaring Bankruptcy.

Paul explains that individuals often miss the initial warning signs or feel shameful about seeking help, causing the debt to snowball, and in some cases leaving the individual with fewer options.

“Each person’s debt situation is unique, which is why meeting with a Licensed Insolvency Trustee for a free, confidential financial review is the best place to start. They will walk through all of the debt relief options available and offer an expert opinion on which would provide the most permanent and cost-effective solution,” advises Paul.

Licensed Insolvency Trustees are federal-regulated and are the only debt professionals in Canada who are qualified to advise on all the debt relief options available. MNP offers free consultations across Canada.